Posts Tagged: Cannabis

UC to present hemp research at field day on Sept. 22

UC Cooperative Extension will host its first industrial hemp field day at UC Davis on Thursday, Sept. 22. The meeting will be held at the UC Davis Agronomy Field Headquarters on Hutchison Drive in Davis.

Industrial hemp is defined as Cannabis sativa L. and required not to exceed 0.3% THC, the intoxicating substance in marijuana.

University of California research on industrial hemp – which can be grown for oil, seed and fiber – began after the 2018 Farm Bill legalized the production of hemp as an agricultural commodity and removed it from the list of federally controlled substances.

At the field day, UC researchers will share research data and participants will explore field plots and learn about the agricultural practices commonly used for this crop.

“There is an abundance of potential end uses with hemp, and this is still very much a new crop with many research needs,” said Kadie Britt, a postdoctoral scholar in the Department of Entomology at UC Riverside and member of the management team for UC Agriculture and Natural Resources' Hemp Agroecology Network. “Growers are working to find their niche in this new and developing market.

Hemp is used as fiber for fabrics and textiles and its seed for oil and food. The cannabinoids, particularly cannabidiol, or CBD, have medicinal and recreational uses.

Registration for the free event will start at 7:30 a.m. From 8 a.m. to noon, attendees will hear from speakers representing the University of California, California Department of Food and Agriculture, California Department of Pesticide Regulation, Beneficial Insectary and Marrone Bio Innovations.

Topics will include hemp agronomy, weed pests, pathogen pests, insect pests, biocontrol use, pesticide use, pesticide resistance avoidance, and California hemp laws and regulations.

All interested people are encouraged to attend. Continuing education credits will be offered for California Department of Pesticide Regulation, Certified Crop Advisers, and Irrigation and Nitrogen Management Plan.

The agenda and more information about the field day are at https://ucanr.edu/sites/hemp/Events.

Registration is preferred, but not required: http://tinyurl.com/fielddayhemp.

Hemp Field Day Preview on KMJ 9-21-22

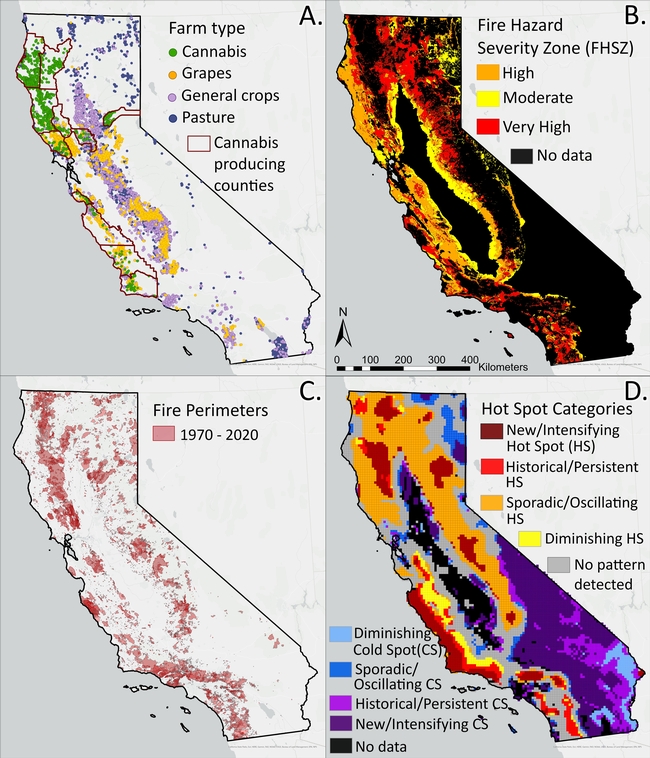

Wildfire poses greater threat to cannabis than other California crops

Wildfires are an increasing threat to people's lives, property and livelihoods, especially in rural California communities. Cannabis, one of California's newer and more lucrative commercial crops, may be at a higher risk of loss from wildfire because it is mostly confined to being grown in rural areas, according to new research by scientists in the Department of Environmental Science Policy and Management at UC Berkeley.

"Our findings affirm that cannabis agriculture is geographically more threatened by wildfire than any other agricultural crop in California,” said Christopher Dillis, lead author of the study and a postdoctoral researcher at UC Berkeley's Cannabis Research Center. “This is an issue in almost all major cannabis-producing counties, not only those in Northern California.”

With licensing to grow commercially in the state only since 2018, the $3 billion cannabis industry is already one of California's top five grossing agricultural commodities (though not included in the California Agricultural Production Statistics because USDA doesn't recognize cannabis as an agricultural crop). In 2020, California tax revenues from legal cannabis sales amounted to over $780 million.

To assess the risk of cannabis crops being burned by wildfire, the researchers analyzed licensed cannabis farms in 11 cannabis-producing counties. Dillis and his colleagues overlaid CAL FIRE maps of fire hazard severity zones, historic wildfire perimeters and areas likely to experience increased fire activity in the future with the locations of cannabis farms and other crops in Humboldt, Lake, Mendocino, Monterey, Nevada, San Luis Obispo, Santa Barbara, Santa Cruz, Sonoma, Trinity and Yolo counties. Legal cannabis cultivation is still prohibited in most other parts of the state.

CAL FIRE classifies fire hazard based on vegetation, topography, climate, crown fire potential, ember production and movement and fire history.

The researchers found cannabis fields were located in “high” and “very high” fire hazard zones and closer to wildfire perimeters more than any other crop. About 36% of the cannabis cultivation area, or 986 farms, were in high fire hazard zones and 24%, or 788 farms, were in very high fire hazard zones. Grapes had the next largest percentage of acreage in high (8.8%) or very high fire hazard zones (2.9%), followed by pasture at 4.3% and 1.7%, respectively.

“This work only serves as a starting point for understanding how vulnerable cannabis farms may be to wildfire, as this analysis did not include indirect impacts, such as smoke and ash damage, which may be far-reaching,” Dillis said. “However, we can confidently say that the places where cannabis continues to be grown are at greater risk now, and likely in the future as well."

For cannabis farms already established in high-risk areas, the authors recommend fire-safety programs to reduce the impacts of wildfire to crops and human health. They suggest traditional wildfire-risk reduction activities, such as managing vegetation and creating fire breaks, but also measures to prevent exposure of farmworkers and crops to wildfire smoke. In addition, they recommend the state pursue options for providing crop insurance to licensed cannabis farmers, which are available for most other agricultural crops through federal programs, but not cannabis.

“In light of the sector's growing economic importance in the state, the vulnerability of cannabis to wildfire should be considered in future cannabis and rural development policies,” said co-author Ted Grantham, UC Cooperative Extension specialist and director of UC Berkeley's Cannabis Research Center.

“The legal cannabis market in California is facing substantial headwinds from both market forces and a burdensome regulatory environment,” Grantham said. “This study shows that cannabis agriculture is uniquely exposed to wildfire impacts, which presents yet another challenge for licensed cultivators in the state.”

The Cannabis Research Center is currently conducting a statewide survey of licensed cannabis cultivators to better understand the impacts of wildfire on crops, infrastructure and farmworkers. The survey is funded through a grant from California's Department of Cannabis Control.

The study “The threat of wildfire is unique to cannabis among agricultural sectors in California” is published in Ecosphere and authored by Dillis, UC Cooperative Extension specialist Van Butsic, postdoctoral researchers Diana Moanga and Ariani Wattenberg, graduate student Phoebe Parker-Shames and Grantham.

California marijuana growers can’t take much to the bank

Study analyzes tension between legal cannabis, financial industry

Legalization of marijuana in California has helped some financial institutions in the state increase their assets. At the same time, many banks, feeling stifled by federal regulations, deny services to licensed growers, manufacturers and retailers, a new study shows.

“Licensed cannabis businesses need to bank their cash and take out loans to build their businesses, but many banks worry that by doing business with the cannabis industry, they'll be flouting federal laws,” said co-author Keith Taylor, University of California Cooperative Extension community development specialist. “Banks that won't accept legal cannabis cash deposits and don't provide loans, aren't monetizing their deposits. Marginalized cannabis communities are missing out on capital.”

Of the banks and credit unions contacted by researchers at The Ohio State University and University of California for the study, most were not knowingly involved in the cannabis industry.

Combining data on bank holdings and interviews with growers and bankers, the research –published online in the journal Agricultural Finance Review – paints an initial picture of how the marijuana and financial industries co-exist in California now, and suggests regulatory changes could create new opportunities for both.

The data analysis did make one thing clear: Legalization of the estimated $16 billion marijuana industry in California has been a boon to financial institutions. But restricted access to banking, from checking accounts to loans, perpetuates inequities for those participating in the legal production of cannabis – while unlicensed, illegal growing and exporting continues as an enormous cash-based sector of the industry.

“We need a better understanding of the economics of this industry and all of the questions and implications related to it so the impacts of policy choices are intentional,” said lead study author Zoë Plakias, assistant professor of agricultural, environmental and development economics at The Ohio State University.

“If we want to have a more equitable society and allow communities to keep more of the value of this crop, how do we do that? We first need to characterize what happens in communities when you legalize cannabis.”

Plakias and Margaret Jodlowski, assistant professor of agricultural, environmental and development economics at Ohio State, conducted the study with researchers Taylor, Parisa Kavousi and Taylor Giamo at the University of California, Davis.

“The tensions we are observing in the cannabis banking space comes about in part due to the inequity felt between large cannabis and small and legacy operators,” Taylor said. “The ‘big guys' are able to absorb a great deal more than ‘Ma and Pa.'”

Legalization benefited financial institutions indirectly

Marijuana is listed as a Schedule 1 drug under the federal Controlled Substances Act. Even in states that have legalized recreational and medicinal use of cannabis, it is still a federal crime to possess, buy or sell marijuana. California legalized recreational cannabis for adults in 2016, and the industry is overseen by the Department of Cannabis Control.

Data used by the researchers for this study included bank and credit union call data for the years 2015-2020. The analysis showed that assets held by financial institutions in counties that legalized marijuana had increased in that period by almost $750 million and loan activity rose by about $500 million.

These benefits are presumed to be spillover effects of better overall economic health that followed cannabis legalization in specific counties, Jodlowski said, because the interviews with financial institutions indicated there has been little appetite among banks to associate with the marijuana industry.

“It's important to remember when talking about loans that it's not possible to identify whether they were for cannabis operations, and they're probably not based on what we heard from stakeholders,” she said. “It's more of a general relationship. The bank is doing better, and they're able to lend out more in general and earn more interest from loans.”

When they narrowed the analysis to banks that operate only in California, the researchers found that for each single new manufacturing or retail license, bank assets and loan capacity grew by tens of thousands of dollars. Cannabis cultivation licenses, on the other hand, had no impact on California banks' holdings.

“This suggests that a lot of the economic benefits of legalization come from other stages of the supply chain – and it's not a foregone conclusion that farmers benefit from legalization,” Plakias said. “There's a need to think about how farmers who are producing cannabis in the legal market, often operating in rural environments with a weaker economic base to start with, can be supported in the context of economic development.”

The team also interviewed marijuana farmers and representatives from banks and credit unions in Humboldt, Trinity and Mendocino counties – the “Emerald Triangle” region known historically in California and nationally for the quantity and quality of marijuana produced there.

Cannabis growers face obstacles, risk-adverse bankers

On the financial side, bankers reported being hamstrung by ambiguous federal guidelines that pose a real risk to financing cannabis, largely because banks are required to report suspicious transactions to the federal government. They might be seen as players in a criminal enterprise even by providing banking services to employees who work for licensed members of the cannabis industry, or they could lose big on lending if cannabis-related assets backing a loan were seized by federal agents.

“What's consistent across all financial institutions is that it's very costly, and does involve taking on some risk, to be in compliance with all of the guidelines – the risk being that even if you follow all guidelines to the letter, there's no assurance that you can't still get in trouble,” Plakias said.

Cannabis growers they interviewed reported paying fees ranging from $200 to $3,000 per month for bank accounts, which they found to be cost prohibitive. These limitations leave most licensed marijuana producers and retailers in the lurch, forcing them to rely on nontraditional financing arrangements – maybe investing in friends' endeavors – or risk running cash operations.

“There is a lot of evidence that cash can be better for a local economy because cash tends to stay local – but we are now a credit-based economy,” Jodlowski said. “In this day and age it's incredibly harmful for local economic development to have an entire sector that's denied access to credit, because so much of developing as a household, or individual, or industry requires credit and requires demonstration of credit-worthiness.

“That's a fundamental harm of these sorts of restrictions.”

This research is part of a larger project on cannabis and community economic development in California supported by a grant from the UC Davis Cannabis and Hemp Research Center. As part of this project, the California authors on this paper recently published a review of the opportunities and challenges marijuana legalization poses for localities in which the crop is cultivated and sold.

“It's clear we need policies making cannabis banking and finance more equitable,” Taylor said. “It's also clear that ‘Ma and Pa' enterprises need to associate together in formal organizations so they can achieve economies of scale and harness their political power to endure the transition to legal.”

Despite the stigma attached to marijuana, even when legal, its status as California's most valuable crop – estimated to be worth more than almonds and dairy combined – attracts outsiders who are better-equipped to come up with funding to get their operations started and compete with legacy growers who have lived and worked in California for generations.

This trend necessitates development of evidence-based policies that take all participants into consideration, the Ohio State researchers say.

“Our findings speak to confusion around existing policies and the need for streamlining, clarifying and having a more unified approach to regulating this industry,” Jodlowski said.

Related reading:

Cannabis and utilities hold potential for economic development, says UCCE specialist

Characteristics of farms applying for cannabis cultivation permits

Cannabis farms irrigating with groundwater may affect stream flows

The legalization of marijuana for recreational use in California has encouraged growers to expand plantings of the lucrative crop. Like any plant, cannabis requires water to grow. A new study from the Cannabis Research Center at UC Berkeley examined where cannabis growers in California are getting water for their crops, highlighting significant gaps in cannabis cultivation policy.

Environmental advocates have expressed concern that cannabis farms are diverting water from rivers and streams, which could harm fish and other wildlife.

The researchers studied water use in 11 of the state's top cannabis-producing counties – Humboldt, Lake, Mendocino, Monterey, Nevada, San Luis Obispo, Santa Barbara, Santa Cruz, Sonoma, Trinity, and Yolo.

Using California state cannabis permitting data, the researchers found that cannabis farms rely primarily on groundwater wells, not streams, for their irrigation needs. But pumping groundwater could also have an undesirable effect on wildlife.

“Wells drilled near streams in upland watersheds have the potential to cause rapid streamflow depletion similar to direct surface water diversions,” said co-author Ted Grantham, UC Cooperative Extension specialist and co-director of the Cannabis Research Center.

The Sustainable Groundwater Management Act, or SGMA, enacted in 2014, is designed to prevent overdraft of groundwater and protect water quality and supplies for agriculture, residents, fish and other wildlife.

But according to Grantham, “Most of the cannabis farms fall outside of the groundwater basins regulated under SGMA, so well use represents an important, but largely unregulated threat to streams in the region."

The researchers found that well use by cannabis farms is common statewide, exceeding 75% among farms that have permits to grow in nine of the 11 top cannabis-producing counties. In eight of the 11 counties, more than one-quarter of farms using wells are located outside of groundwater basins subject to state groundwater use regulations. Farms growing larger acreages of cannabis pumped more groundwater for irrigation, while farms with on-farm streams or located in areas that receive more rainfall were less reliant on wells.

The study relied on water-source data only for cannabis farms that have state permits to grow.

Based on models, the researchers estimate the majority (60%) of unregulated Northern California cannabis farms in Humboldt and Mendocino counties are likely to use groundwater wells if they follow the same patterns as the regulated industry.

“Our results suggest that proactive steps be taken to address groundwater use in cannabis regulations in California and call for further research into the effects of groundwater use on streamflow, especially outside of large groundwater basins,” write the authors.

The paper, “Cannabis farms in California rely on wells outside of regulated groundwater basins,” by Christopher Dillis, Van Butsic, Jennifer Carah, Samuel C. Zipper and Grantham is published in Environmental Research Communications at https://doi.org/10.1088/2515-7620/ac1124.

Cannabis and utilities hold potential for economic development, says UCCE specialist

As California strives to recover from the pandemic-induced economic slump, Keith Taylor is taking an unconventional approach to economic development. In the world's sixth biggest economy, where do you start? Taylor, who was hired in 2017 as UC Cooperative Extension's sole specialist in community economic development, started by tackling a couple of the state's thorniest sectors: cannabis and utilities.

Participatory research in Mendocino County

In 2016, the passage of Prop. 64 legalizing recreational cannabis ushered in an era of both opportunity and headaches for Mendocino County growers. The county's permitting program has been the source of significant confusion and debate: Between 800 and 1,100 growers have received county permits, but many have not been able to obtain permanent state licenses because of a lack of clarity around the county process and compliance with the California Environmental Quality Act. The burden of uncertainty is one reason why only a fraction of Mendocino growers have pursued licenses, says Taylor, who is based in the Department of Human & Community Development at UC Davis.

While these regulatory battles play out, Taylor says better economic coordination between small growers could buffer them against large capital interests moving into cannabis. Virginia-based Altria, the parent company of Philip Morris USA, is investing in cannabis and filing patents for cannabis-specific vaporizers. Individual legacy growers have the crop experience and market share, Taylor says, but don't have shared institutions through which they can exercise collective power — especially down the value chain in processing, distribution and consumer technology. Taylor believes that creating a small farmer-centric system will involve the creation of more interest groups, associations or cooperatives.

“For too long in agricultural and rural communities, we've encouraged people to do things alone,” Taylor said in an October 2020 presentation to the UC Davis Cannabis and Hemp Research Forums. However, if you look at parts of the world where rural economies do very well, they work together.”

With help from a Cannabis and Hemp Research Center grant, Taylor has been working on a wide-ranging participatory action research project in Mendocino County. Taylor's team — comprised of two faculty members, one post-doctoral researcher, and two student researchers — is producing research publications, policy recommendations and public events about ways that the emerging cannabis industry can support high-quality livelihoods and environments for county residents.

“The more we make folks aware of these good actors, the more likely we are to get challenges to the incumbents in terms of climate mitigation and economic developments,” Taylor said.

West Business Development Center, Economic Development & Financing Corporation and Mendocino County Supervisor John Haschak have been allies in the process so far. Haschak says Taylor brings valuable knowledge, resources and networks to bear on local challenges.

“There's a lot of opportunity for doing this whole new industry in a new way, and I think that's what Dr. Taylor sees too,” Haschak said. “There's a lot of potential here for structuring the industry along the lines of what our community values already are.”

As Taylor's team releases their findings, they intend to host forums at the Hopland Research and Extension Center to help the county harness the legal cannabis sector for economic impact.

Power to the people

Shortly after arriving at UC Davis from Illinois, Taylor published a book about the benefits of community ownership of wind energy in the Midwest. The turmoil surrounding California's largest utility, Pacific Gas & Electric, could have been ripped from the pages of his research. PG&E equipment has ignited half of California's most destructive fires since 2015, and experts pin much of the blame on the company's lack of investment in the grid.

In the months following the 2018 Camp Fire, which burned an area roughly the size of Chicago andkilled85 people, Taylor was one of the first advocates to propose converting PG&E into a user-owned nonprofit cooperative. This conversion would remove the extractive role of investors and give customers a voice in big-picture decisions about the company, Taylor wrote in an op-ed pushing the idea of customer ownership in The Mercury News in February 2019. By December, more than 100 elected officials across 10 counties endorsed the idea. The federal bankruptcy judge overseeing PG&E's case did not endorse the plan, although it's still possible for the state to take over the company under certain conditions. Other attempts to gain local control of PG&E's grid — including San Francisco's bid to buy the city's power lines from the company — also stalled.

Taylor isn't discouraged. He is working closely with the Golden State Power Cooperative, an association of the state's three community-owned electric utility co-ops, to push forward what he calls a “Rural Electrification Act for California broadband.” Taylor often references this New Deal-era law that gave federal loans to rural communities seeking to expand the electrical grid to their area. The act gave rise to the nation's more than 900 electric cooperatives today, including the three in California. With their help, Taylor sees opportunity in legislation or programs that would catalyze community-initiated, community-owned internet services. Plumas-Sierra Rural Electric Cooperative is already bringing broadband to the rough terrain of its mountain customers.

“When you first set foot in California and are exposed to the giant that is PG&E and their influence over policy, you think that it's an obstacle that's too difficult to overcome,” Taylor said. He tries to elevate the visibility of people who are making inroads and recently featured Kevin Short in a webinar about community economic-development innovations.

Short is the general manager of Anza Electric Cooperative in California's high desert and current board president of the Golden State Power Cooperative. He said there are “tremendous opportunities” in the idea of growing cooperative broadband entities, especially with the attention on infrastructure at the state and federal levels. Short said the effort will take some creativity and willingness to depart from existing models: “The old saying among us here is if you've seen one co-op, you've seen one co-op, because it's going to be different everywhere you go.”

In both of these areas — cannabis and utilities — Taylor says his role is networker and facilitator. As the only economic development specialist at UC Agriculture and Natural Resources, he spends a lot of time researching and meeting people to understand where his efforts can be the most strategic. “In order to scale, I've got to go small, root and build and be comfortable with that process,” he said.

Small works for now, but Taylor remembers an associate dean telling him, “You've got a great job, now make it work for 40 million Californians.”