Unauthorized immigrants pay taxes

Tax Day is an appropriate time to underscore the fact that unauthorized immigrants pay taxes. To do just that, the Immigration Policy Center published a brief showing the contributions these immigrants make as taxpayers.

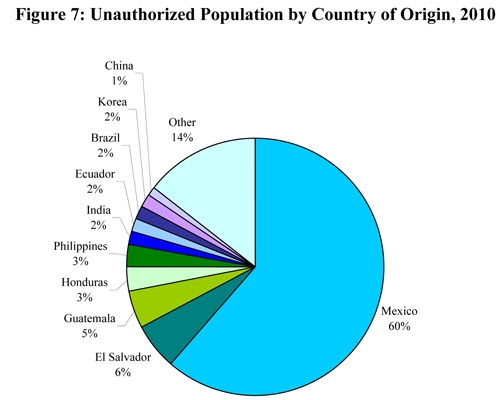

According to the Department of Homeland Security estimates, 60 percent (three-fifths) of the unauthorized population was from Mexico as of 2010. The other top countries of origin were El Salvador (6 percent), Guatemala (5 percent), Honduras (3 percent), and the Philippines (3 percent)

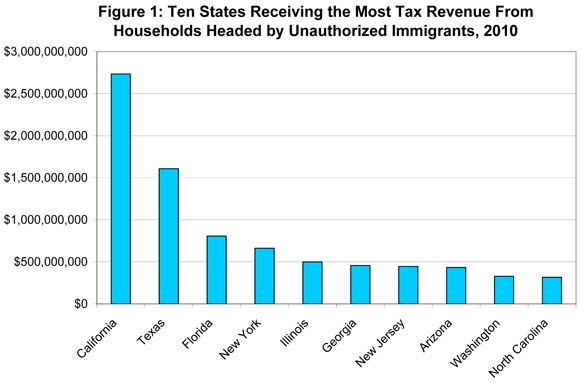

The unauthorized, like everyone else in the United States, pay sales taxes. They also pay property taxes—even if they rent. At least half of unauthorized immigrants pay income taxes. Add this all up and it amounts to billions in revenue to state and local governments. The Institute for Taxation and Economic Policy (ITEP) has estimated the state and local taxes paid in 2010 by households that are headed by unauthorized immigrants. These households may include members who are U.S. citizens or legal immigrants. Collectively, these households paid $11.2 billion in state and local taxes. That included $1.2 billion in personal income taxes, $1.6 billion in property taxes, and $8.4 billion in sales taxes.

Source: Immigration Policy Center, “Unauthorized Immigrants Pay Taxes, Too,” April 18, 2011.