Financial Risk

What Is Financial Risk?

Arises from the cost of debt capital, cash flow needs, and the ability to maintain and grow equity.

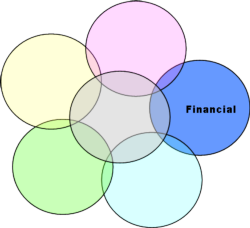

Financial risk is intimately linked with other forms of risk, so you are multitasking when you plan for it and deal with it.

Jump directly to resources.

Some Sources of Financial Risk

- Production risks

- Price risks

- Inaccurate estimates of cash flows, past performance, and future production

- Incomplete understanding cash flows, past performance, and future production

- Inflation

- Changes in interest and exchange rates

Some Questions to Ask to Assess Your Financial Risk

Financial Planning:

- What are my short-term and long-term goals? How do they affect my financial planning?

- Are my family's needs being met?

- Do I keep family finances separate from business finances?

- Which records do I need to monitor my operation's financial status?

Financial Well-being of Operation:

- Am I able to protect or grow my equity (solvency)?

- What are some alternative sources of financing I can explore?

- Do I completely understand the terms and conditions of my borrowing, including interest rate calculation?

- What types of personal and property insurance do I need?

Cash Flow Questions:

- Am I able to pay the farm’s cash obligations in a timely manner (liquidity)?

- What is my contingency plan for cash flow if a crop fails or I don't sell for the expected price?

- What are my cash flow needs?

- How can I reduce cash expenses?

- What are some alternative sources of income for me?

- What are my tax obligations?

Source: USDA Risk Management Agency. "Introduction to Risk Management: Understanding Agricultural Risks." Revised December 1997

Tools for Mitigating and Planning for Financial Risk

- Financial planning.

- Analyze market trends.

- Establish alternative sources of financing or income.

- Use personal, property, and crop insurance as risk management tool.

- Proper business structure.

- Proper estate planning (transfer of ownership, retirement planning).

- Remember emergency assistance through FSA and other organizations.

- Develop a contingency plan.

Remember: It's important to choose the tools that are best for you, your level of risk tolerance, and your operation.

Resources

General:

- Risk Management Checklist - USDA Risk Management Agency

- Calculating the "Sweet 16" Farm Financial Measures - Penn State. Useful measures and tools to help evaluate your operation's financial efficiency.

Financial/Business Planning:

- Cost and Return Studies - UC Davis Ag Econ. Use these studies on a wide array of commodities to assess the viability of a current or future enterprise.

- Farm Finances: Organizing and Understanding Your Numbers (Webinar) - NCAT with USDA RMA. A new webinar that can smooth the road for anyone who is beginning a journey in agriculture and wants to get comfortable with handling finances.

- Planning for Profit in Sustainable Farming - ATTRA. Guide to increasing your chances of operating profitably through careful planning.

- Farm Business Planning - Farm and Ranch Survival Kit (Issue 1) - Oregon State University. Short articles about the importance of thinking about and planning for a profitable agricultural business.

Financial Well-being:

- Family Insurance Planning - Farm and Ranch Survival Kit (Issue 5) - Oregon State University. Newsletter with short articles about taxes, family insurance planning, and legal dilemmas.

Cash Flow:

- Preparing and Analyzing a Cash Flow Statement - Colorado State University Extension

- Assessing and Improving Your Farm Cash Flow - Maryland Cooperative Extension

Additional Financial Risk Management Resources