Calag Archive

Calag Archive

Sidebar: Is “free trade” really free?: How the FTA will affect California agriculture

Publication Information

California Agriculture 45(5):7-8.

Published September 01, 1991

PDF | Citation | Permissions

Abstract

Abstract Not Available – First paragraph follows: While the accompanying article discusses potential free-trade impacts on agriculture as a whole, it does not focus on individual industries. Within each agricultural sector there will be winners and losers. Much attention in California has focused on the potential losses in the domestic production of vegetables caused by increased imports of such products from Mexico. One difficulty in assessing the impact of such production and trade shifts is the lack of adequate data to permit sound analysis. Therefore, much of what is concluded is based on structural descriptions and opinions about relevant economic relationships.

Full text

While the accompanying article discusses potential free-trade impacts on agriculture as a whole, it does not focus on individual industries. Within each agricultural sector there will be winners and losers. Much attention in California has focused on the potential losses in the domestic production of vegetables caused by increased imports of such products from Mexico. One difficulty in assessing the impact of such production and trade shifts is the lack of adequate data to permit sound analysis. Therefore, much of what is concluded is based on structural descriptions and opinions about relevant economic relationships.

The United States International Trade Commission (ITC) concludes that a free trade agreement (FTA) would significantly increase U.S. imports of horticultural products from Mexico. These results are consistent with many other studies with single-country and multi-country, trade-focused CGE models. The basis for this conclusion is that U.S. tariff and nontariff barriers for horticultural products are relatively high and U.S. demand for Mexican products is relatively price-elastic (in other words, if the product price drops by a certain percentage, the quantity of it sold will increase by the same or a greater percentage). The removal of barriers could result in significant price reductions and that, given the price sensitivity, would lead to proportionately more imports. Research is currently underway at the University of California to measure the impact of the FTA on California as distinct from the U.S. economy.

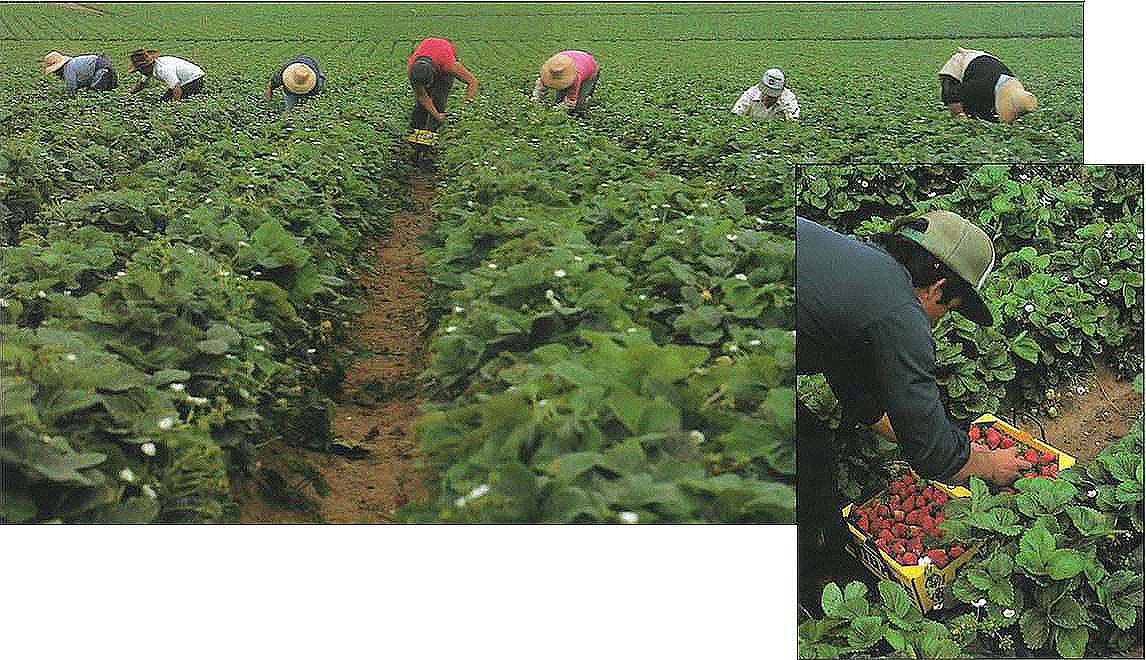

The ITC expects that the fresh products most affected will include tomatoes, cucumbers, asparagus, broccoli, cauliflower, lettuce, peppers, onions, squash, avocadoes, citrus fruits, grapes, melons, guavas, mangoes, and fresh cut roses. Some of these products are exported during periods when they are not produced in California and others are directly competitive with the California product. The ITC also expects increased imports of processed tomato products, frozen broccoli and cauliflower, frozen strawberries and orange juice concentrate.

Measurement of the impact that these changes would have on California and U.S. production of horticultural products is difficult. In the case of frozen broccoli and cauliflower, Mexico has already garnered a major share of the U.S. market because of significantly lower production costs and good product quality. This has caused plant closures in California and the loss of several thousand jobs as capital moved south to Mexico. Eliminating the tariff would make imports from Mexico more attractive. If the U.S. tariff was removed, import prices might drop by 15 to 20%, leading to a similar or greater percentage increase in imports. Such an increase is small when compared to the over 60% increase in imports that occurred between 1988 and 1989. The steady growth in imports, despite a high U.S. tariff, indicates that a developing industry can find a market position if the fundamental economic factors are favorable.

The tariff removal on fresh tomato imports could lead to moderate increases in imports, since the ad-valorem value of the U.S. tariff was close to 14% for imports during the winter period 1990-91. In 1990, Carlos Benito of the Berkeley Research Institute argued that the overall demand for winter tomatoes in the United States was relatively inelastic, but that imported tomatoes faced a residual demand to fill out U.S. supplies, with a price elasticity that is higher than one (if price drops by a certain percentage, quantity sold will increase by more than that same percentage). Hence an elimination of import tariffs could lead to a moderate (15%) increase in imports. More significant to import levels would be the removal of production and export restrictions imposed by the Mexican National Vegetable Producers Association (Confederation Nacional de Productores de Hortalizas, or CNPH). Given the virtual dismantling of CNPH because of reduced (or eliminated) government funding, these restrictions may be eliminated by default. If buyers begin to accept Mexican winter tomatoes as perfect substitutes for U.S. produced tomatoes, then the added exports by Mexico caused by relaxed export restrictions could cause a significant lowering of price until U.S. production diminished.

Mexico is in a good position to expand its exports of processed tomato products if U.S. tariffs are lifted. ( See related article, p. 11 .) Removal of the 13.6% U.S. tariff would lower by 3 or 4¢/lb the cost of Mexican tomato paste, duty paid at the U.S. border. If this cost reduction were reflected in import price reductions, Mexico could undersell many California producers in eastern markets by 10%. Over time this would cause some U.S. producers to give up tomato paste processing.

Asparagus imports from Mexico grew rapidly between marketing years 1989-90 and 1990-91. If tariffs were dropped, more imports would be attracted at prices below what they would otherwise be. The increase would be at the expense of U.S. producers. ( See related articles, pp. 21 , 24 .) For example, if imports increased total asparagus supplies by 20%, a price reduction of 8% in the short run might be expected based on a price flexibility estimated by UC Davis Professor Ben French. This would be tempered in the long run as U.S. growers reduced their production in response to lower prices. Such a reduction in California asparagus production would result in job loss or diversion to other products.

The FTA would lead to increased U.S. horticultural exports to Mexico, just as it would for other U.S. agricultural commodities. The gains are expected to be modest because ITC estimates that demand is only moderately price-elastic. Horticultural products facing potential export growth include wine, canned peaches and pears, fresh apples and pears, and some canned vegetables. Exports of tree nuts may be enhanced also, particularly by increases in Mexican buying power stimulated by economic development. On balance, however, the export gains would not offset the losses to other horticultural producers. The ITC concludes that a free trade agreement is likely to result in moderate harm to the U.S. horticultural industry, with California, Florida, Texas and Arizona suffering losses in production and employment.

The grain and oilseed sector would gain from a free trade agreement with Mexico because the Mexican sector is highly protected and has higher costs than in the United States. This would have a small impact on California which has a very small share in the exports of these products. Expanded meat imports to Mexico might be beneficial for California meat packers, although this would not have much of an impact on the industry because of its low export propensity. The import of feeder cattle from Mexico is expected to increase and this could displace some feeder cattle from California, adversely affecting cow-calf operations. ( See related article, p. 18 .)

Overall, it is likely that California's horticultural sector will be more affected by the FTA than other sectors. It will experience a reduction in output or shift in production mix for commodities directly competitive with Mexico's products. In those sectors where production seasons are complementary, little or no effect is likely. As Mexico's economy grows, there will be long-run opportunities for California's horticultural products in Mexico's “offseason” markets.

To the extent that the FTA results in equitable production and environmental standards between the countries, and equivalent concerns for worker health and safety, then trade and competition will benefit. These conditions could lead to an increase in Mexican costs and a decrease in their exports in the short run, but in the longer term would encourage more efficient practices and help assure that trade responded more closely to comparative economic advantage. And, as pointed out in the accompanying article, economic development and growth in Mexico should generate long-term trade opportunities that will be attractive to California.