Calag Archive

Calag Archive

Commodity advertising pays… or does it? What it takes to keep those raisins dancing

Publication Information

California Agriculture 46(2):8-12.

Published March 01, 1992

PDF | Citation | Permissions

Abstract

California's farmers collectively spend more than $100 million a year to promote their products. Here are answers to such questions as: Where is the money spent? What are the public policy issues associated with government-sponsored generic commodity advertising? How successful are those campaigns? And finally, how can commodity groups improve their data bases?

Full text

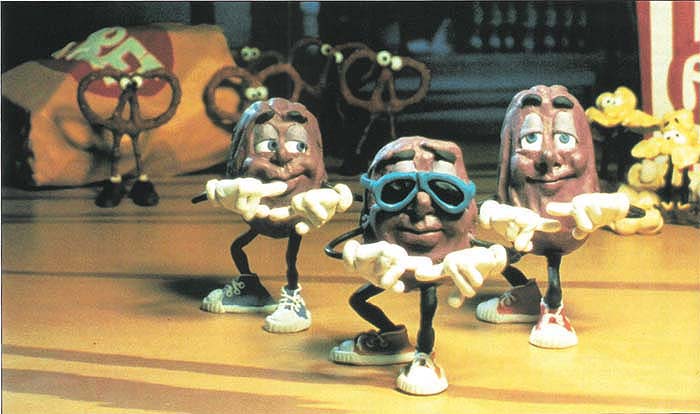

Above and opposite page, billboard advertising by the Milk Advisory Board. Below on opposite page, raisins dance to “I Heard It On the Grapevine.”

Raisins dance madly to “I Heard It on the Grapevine.” Growers, chests deep in almonds, implore you to “eat one can a week—that's all we ask.” Athletes knock back man- (and woman-) sized glasses of milk (“It does a body good.”). Friends of eggs, once nutritional bad guys, now appeal, “Give 'em a break.” and delectable pictures of gourmet meals — cacciatore, tetrazzini, amandine, kiev — are advertised as lighter, leaner and all made with white meat. But the meat isn't chicken or fish. It's pork (“the other white meat”).

These “visuals” represent millions of dollars in television advertising by agricultural producers, but they are just the tip of the iceberg. Even more is spent on lower profile campaigns on radio and in newspapers, mass circulation magazines, point-of-purchase materials (such as recipes), trade publications, billboards, and other promotions.

Few consumers exposed to these efforts are aware of the many relatively small agricultural producers who have joined in promoting their products or of the public policy issues associated with government sponsorship of commodity promotions. This article discusses the institutional framework for these producer-financed programs, summarizes the promotion expenditures of some California commodity groups, outlines issues raised by commodity advertising financed by mandatory producer assessments and briefly discusses approaches to evaluating government-sponsored commodity group promotions.

Funding advertising

Generic advertising and commodity promotion are designed to increase demand — and sales — for a relatively homogeneous commodity produced by many farmers. They usually contain both information and persuasive messages. The objective: to increase demand for all brands of the commodity, as opposed to brand advertising which seeks to increase sales of one brand at the expense of other firms offering the same product. A successful promotion program usually requires that (1) the commodity group account for a high proportion of the supply of the crop and (2) the vast majority of producers support the program.

California producers are particularly prominent in agricultural commodity advertising and promotion programs because they produce many specialty crops, enjoy favorable legislation at both state and federal levels, and have a tradition of group action. California is the major or only U.S. producer of such specialty crops as almonds, pistachios, walnuts, artichokes, avocados, kiwifruits, nectarines, olives, cling peaches, dates, raisins and prunes. Because California producers control most of the supply of these crops, they are in a position to capture the benefits of advertising to increase demand for them.

California specialty crop producers have long taken group action to solve commodity marketing problems, and state and federal marketing orders provide the mechanism for developing and funding producer marketing programs. Once enacted, provisions of both state and federal marketing orders are binding on all producers of the affected commodity, thus avoiding the “free riders” who can ultimately destroy voluntary industry marketing programs. “Free riders” enjoy all the benefits of an advertising, quality control or supply management program without paying any of the costs or subjecting themselves to any of the controls required by a marketing program.

Enabling legislation for marketing order programs became available at the state level with passage of the California Marketing Act of 1937 and at the federal level with the Agricultural Marketing Agreement Act of 1937. Federal marketing orders tend to focus on volume control and quality regulations; California marketing orders tend to focus on research programs and promotion. Federal marketing orders apply to a specified group of fruits, vegetables and specialty crops and can cover producers in more than one state; California marketing orders can apply to any crop grown in California.

California has 27 active marketing orders under the California Marketing Act of 1937, 19 more marketing orders authorized under federal legislation, 10 commodity groups organized as state commissions, 2 council programs authorized under state legislation and 1 commodity group operating under the California Agricultural Producers Marketing Law. Government-sponsored marketing programs cover over 80% of California's fruit and nut crops Glased on either value or acreage) and over 60% of California's vegetable production. During fiscal 1988-89, California producer groups collected just over 1% of total revenues (approximately $150 million) from their members and spent it on advertising and promotion, research, quality control and administration. The largest expenditure, almost $115 million, went to “demand expansion activities” — advertising and promotion. More than three fourths of demand expansion activities were carried out under California programs; the rest developed under federal marketing orders.

California commodity groups also take advantage of government matching fund programs to expand exports by advertising and promotion in foreign markets. To obtain matching funds, a commodity group or firm must apply for and obtain approval of detailed marketing plans. USDA's new Market Promotion Program (MPP), which replaced the Targeted Export Assistance Program (TEA), allocated $72 million to 14 California commodity organizations for fiscal 1991. The largest allocations were for wine ($15 million), Califorrria-Arizona citrus ($13.7 million), raisins ($8.5 million), almonds ($8.2 million), walnuts ($8 million) and prunes ($7 million). Other California commodity groups receiving funds included those exporting avocados, cling peaches, kiwifruits, pistachios, strawberries, table grapes, fresh tree fruits and dates. California producers also benefit from allocations for fresh and processed pears, cotton, rice and processed tomato products. Furthermore, a California state program, the California Agricultural Export Program, has provided almost $15 million to 350 companies or cooperators over a 4-year period.

Advertising spending

Advertising and promotion expenditures by California commodity groups operating under government-sponsored programs, together with total program expenditures and total crop values, are presented in table 1. Some 18 to 20 other federal and California marketing order programs provide for research, quality control or supply control, but they do not provide for advertising and promotion; they are not included in table 1.

TABLE 1. California commodity group budgets for advertising and promotion, total budgeted expenditures, farm value of each commodity, and advertising as percent of total value, 1988-89 marketing for 1989 calendar year

California crops with large demand expansion expenditures during 1988-89 included almonds ($14.9 million), avocados ($7 million), table grapes ($5.9 million), fresh strawberries ($2.9 million), raisins ($19 million), prunes ($7.6 million), walnuts ($8.6 million), milk ($19.7 million) and eggs ($4.5 million). Commodity groups spending more than $1 million annually on demand expansion included kiwifruit, lettuce, nectarines, olives, peaches (cling and fresh), pistachios and plums. Note: Expenditures change from year to year, depending on crop size, programs conducted and assessment rates.

There is a wide range in the percentage of farm level crop value spent on advertising and promotion, as is evident in table 1. For example, four commodity groups spent more than 4% of their total crop value on advertising and promotion: kiwifruit, 4.6%; prunes, 4.5%; raisins, 5.8%, and walnuts, 4.1%. Groups with advertising and promotion expenditures totaling more than 2% of crop value included almonds, figs, table grapes, olives, peaches, pears and pistachios. Many commodity groups have long-standing advertising and promotion programs, spending millions to expand demand for their products. Avocado growers, for example, spent almost $53 million for advertising and promotion during a 20-year period, 1967-86.

Budgets influence the nature of advertising and promotion programs conducted by commodity groups. Only commodity groups with big budgets can undertake television campaigns on behalf of, say, almonds, beef, eggs, milk and raisins. Two of these national television campaigns have received advertising industry recognition: the almond campaign for its slogan and the raisin campaign for its dancing raisins. Commodity groups with smaller budgets concentrate on cooperative newspaper advertising with retailers in selected markets, on providing point-of-purchase materials to retailers, on magazines going to targeted groups, on trade publications, on radio spots in selected markets, and on consumer information, such as recipes and nutrition data. They also retain agencies to conduct promotions with various media and to place news stories about the commodity for special food pages in newspapers: recipes, preparation suggestions or nutritional pointers.

Advertising issues

Controversy concerning producer-funded advertising and promotion for agricultural commodities has gone on for almost as long as the programs have existed. Major questions concern the mandatory nature of producer assessments, the potential and actual effectiveness of commodity advertising, the cross-commodity effects of advertising, the short-run versus long-run effects of advertising programs, the merits of brand versus generic advertising, and the best way to spend advertising money. As one might expect, the questions are related.

Mandatory assessments. Marketing order assessments to support an advertising and promotion program (collected at the first handler level) are mandatory for all producers of the covered commodity, whether or not they favor the order. While this prevents free riders, the loss of individual freedom in decision-making guarantees criticism by some producers, who may be philosophically opposed to advertising or simply skeptical of projected results. Given the lack of solid analysis of the impact of advertising and promotional programs, such skepticism is not surprising.

Brand owners, such as Sun Maid, Dole and Blue Diamond, are concerned about contributing to generic advertising when they also spend substantial sums advertising their own brands. Some, but not all, of the programs give brand owners credit for brand advertising.

Advertising effectiveness. Problems associated with measuring the impact of advertising on product sales and the claims of those supporting increased commodity advertising were well known nearly 50 years ago. Alois Wolf, in a 1944 Journal of Farm Economics article, provided a critique of advertising results reported for several commodities, including a claimed return of $38 for every $1 spent advertising grapefruit by the Florida Citrus Growers' Clearing House Association during the 1931-32 marketing season. He used examples for other commodity groups, including Washington apples, Maine potatoes, California cling peaches, Rio Grande citrus, New York State milk and Diamond Brand walnuts, to illustrate the point that “data often have been worked up by interested parties to prove a biased case.”

Wolf discussed four types of erroneous statistical procedures employed by state and private agencies in promoting claims of benefits derived from advertising, including (1) the before-and-after analysis, (2) comparisons of different geographic areas, (3) analysis of price differentials and price changes and (4) trade opinions. Wolf found no attempts to measure the effectiveness of advertising by analyzing shifting demand curves, inflation-adjusted grower income or changing consumer expenditures.

Measurement of advertising results by industry participants focuses on such factors as exposure, recall, image and perception. Thus, industry participants often make the kinds of claims outlined by Wolf. It is not unusual to read commodity organization press releases that compare sales this year with sales last year (with and without advertising) or that describe the success of an advertising program in terms of changes in the consumers' perception of the product.

Lack of data, industry cooperation and funding hamper advertising research by economists. Marketing orders and commissions report expenditures annually in four categories: advertising and promotion, research, inspection, and administration. Expenditures for advertising and promotion are not separated by type, media or time, and categories may overlap. It is not clear, for example, how some administrative expenses for advertising are classified. Advertising expenditures are used as a measure of advertising effort, but this approach often fails to account for differences in the quality of advertising — or the different media used. However, when data are available, researchers, have deflated advertising expenditures by a media cost index to account for different media effects. Data on the promotional activities of competing products are always difficult to secure.

Many grower organizations, familiar with the need for accurate data covering a significant time period and aware of the problems and costs of performing “good economic analysis,” consciously avoid funding economic research on the impact of past advertising. One commodity group manager, who supervises a large annual advertising budget, commented: “My board of directors recognizes that advertising research is costly. They prefer to spend their limited budget on additional advertising rather than on evaluation since they see little tangible benefit from evaluation efforts.”

Statements such as this, together with industry promotional programs that have operated for many years, leads one to conclude that the producers who have been funding these long-standing programs believe the expenditures are justified. But, producer groups are not unanimous in their support of advertising and promotion, as evidenced by termination of marketing orders with these provisions by producers of California apples, brandy, bushberries, potatoes, wine and cantaloupes.

Researchers are progressing in evaluating the impact of advertising programs on agricultural commodity sales. Some large-scale national check-off programs include legislative provisions that require economic evaluation of program impacts and provide for data collection and funding of such programs. (With a national check-off program, a fixed amount of money per unit of product sold — such as per head of cattle or per cwt. of milk — is collected at the first handler level and placed in a commodity promotion fund.) There have been several studies of dairy promotion programs, the Florida Citrus Commission has evaluated some of its promotional programs, and evaluation of the national beef and pork programs is planned.

A growing collection of research results indicates that nonbrand commodity advertising programs can increase demand and that there may be significant lagged effects from a promotional program. Cornell University researchers studying New York fluid milk advertising expenditures found an optimal seasonal advertising pattern that reflected the seasonal Class I price differential; for best results, they found, state promotional programs should be coordinated with the national program. The studies also show that sales response to advertising can differ significantly in local retail markets.

Cross-commodity effects. Because there are degrees of substitution among most food products, an advertising program that increases the demand for one product may decrease the demand for another. Thus, the gains to one group of producers may come at the expense of another, and the response may be to engage in a defensive advertising program. The net result of the advertising programs, after a period of adjustment, may be nearly equivalent pre- and postadvertising sales, market shares and prices with advertising built into the cost structure.

Although there is little analysis of cross-commodity effects of advertising, some national beef and pork advertising appears competitive. Preliminary results from analyzing the effects of producer advertising on the demand for dried fruits (raisins, figs and prunes) indicate that generic advertising effects are generally weak when compared with price and total expenditure effects. For example, raisin advertising appears to have increased the demand for raisins, but our estimates indicate that a 10% increase in advertising spending is required to increase demand by 1%. Even this small response can be profitable, depending on the level of advertising, crop values, costs and the existence of reserve tonnage.

The cross-commodity effects of advertising has also been found to be relatively small, except for the effect of raisin advertising on the quantity of prunes demanded. Here, the current short-run, cross-advertising elasticities of -0.226 indicates that a 10% increase in advertising for raisins reduced the quantity demanded of prunes by 2.26%. Prune producers, therefore, may be obliged to overcome the negative impact of increased raisin advertising on the demand for prunes.

Our research on the cross-commodity effects for dried fruit advertising reveals serious data limitations and emphasizes the need for improving data collection. For example, the careful collection of more frequent observations (quarterly, monthly or weekly) by type of advertising, together with unit sales and prices for sets of competing commodities, would enable analysts to improve estimates of direct and cross-advertising elasticities.

Advertising effects over time. A competitive industry's response to successful advertising is likely to be increased production (perhaps with the entry of new producers) so that there is little or no long-run increase in price and profits. The total gains to producers from an advertising program depend on the effect on demand, the supply elasticity for the product and the nature of the lags involved from the time production decisions are made until the product is ready to market. Short-run gains to producers of a tree crop can extend over several years.

A preliminary analysis of California's avocado advertising, which has been effective since 1961, indicates that early estimates of returns to costs ranged from $5 to $30 for every dollar spent for advertising, and that these increased returns became responsible for a sharp expansion in avocado acreage and supply. Thus, while advertising increased the demand for avocados, short-run increases in prices and revenues were eventually eroded by increasing acreage and supplies. Those producers who had bearing acreage in place at the beginning of the program, however, realized very attractive returns for their advertising money. Because of increased production (due to more planted acreage than would have otherwise existed), it is possible that current prices and total revenue per acre are no greater with advertising than would have existed without the industrywide advertising program. Likewise, reduction of current advertising spending would likely lead to reduced prices and per-acre revenues.

Brand versus generic advertising. There is a general feeling that promotional programs are more successful for well-differentiated than for homogeneous products. Thus, commodity advertising programs are often based on brand or regional identification as a method of differentiation. While there are some success stories, (e.g., Washington apples and Idaho potatoes), many efforts to differentiate commodities by area of production have failed. Until recently, brand advertising was not permitted under marketing order or commission programs. Now, a few California marketing programs provide credits against assessments for processors promoting products using their own brand (almonds, prunes, raisins and walnuts). The almond industry uses this provision more than any other group.

Optimal advertising expenditures. Although theoretical models for determining optimal advertising expenditures are available, lack of data and specific knowledge concerning the nature of sales response to advertising expenditures and supply response to increased prices prevents their routine application in establishing budgets. Limited attempts to develop optimal advertising rules have been made for processed grapefruit, fresh oranges and fluid milk, but generalizations are not possible. Thus, one is unable to answer simple questions asked by many farm groups, such as “Should we promote and advertise? If we advertise, how should we structure our program? How much should we spend on advertising and will it pay?” For example, the Raisin Board's advertising campaign has received national attention and awards, but despite the “success” of the dancing raisins, growers still do not know the level of returns they have received for their $26 per ton assessment for advertising (plus the processors' $26 per ton assessment) or whether the $19 million they are spending is too little or too much.

The raisin industry differs from other California commodity groups with nonbrand advertising and promotion programs only in the amount of money spent and the recognition accorded its program. Administrative committees for most of the government-sponsored advertising and promotion programs are making budget decisions based more on faith than on quantitative knowledge of the response of sales and profits to advertising expenditures. This situation will probably continue until there is an organized effort by industry committees to improve data collection and reporting related to their advertising and promotion programs.

Future developments

Agricultural commodity promotion has become more noticeable during the last 3 years as a result of national attention accorded advertising campaigns by the California raisin and almond industries and programs conducted by beef, pork and milk producers. While new programs of the scope of these programs initiated by other commodity groups will be limited by funds, there is significant commodity group interest in national, coordinated, promotional programs. In addition, the federal government's Market Promotion Program (MPP), together with the California state export promotion program, have stimulated interest in agricultural commodity promotion and its impacts. Continuing price and income pressures facing agricultural commodity producers are once again increasing their interest in programs to enhance consumer demand for their products.

Few efforts have been made to evaluate the economic impacts of advertising and promotion programs conducted by California commodity groups under state and federal enabling legislation. Thus, it appears that advertising and promotion expenditures exceeding $100 million annually are based more on faith than on hard analytical evidence. This makes it difficult for either new or existing groups to evaluate the feasibility of proposed promotional programs. As a result, producers tend to be susceptible to misleading evidence presented by biased participants. While industry groups are primarily concerned with the impact of advertising on the demand and price of their commodity, analysts should also be aware of the need for more comprehensive treatment of economic welfare issues for consumers and the economic implications for other commodity groups.

It is reasonable to expect increased attention to evaluations of commodity advertising because of the high visibility and large sums spent. Such evaluations will require careful attention to data requirements and measurement problems. Commodity groups interested in systematic evaluation of the economic impacts of their programs should develop data collection plans as they develop their annual advertising and promotion plans and budgets.

Basic data requirements, which could be part of the marketing order's information reports, include unit sales and average prices by grade and advertising expenditures. These data should be collected monthly during the marketing year. Analytical opportunities can be improved with sales, price and advertising data for separate market areas and with details on advertising and promotion activities, such as measures of media used (space, exposures, circulation, time, target audience, etc.).

The large, well-funded, national programs have been leaders in economic evaluations of commodity advertising programs. However, with systematic attention to data collection over time, commodity groups with limited budgets can develop data bases that will (1) enable analytical evaluation of the effectiveness of their programs and (2) provide background for improving program decisions. Timely dissemination of these data can also lead to improved decision-making by industry participants.