Calag Archive

Calag Archive

Sidebar: Long-term care is an important consideration in financial planning for later life

Publication Information

California Agriculture 64(4):206-206. https://doi.org/10.3733/ca.v064n04p206

Published October 01, 2010

Full text

“Long–term care” refers to a variety of services and supportive measures to meet health or personal care needs over an extended period of time. Most long-term care is nonskilled personal care assistance, such as help with the everyday activities of living.

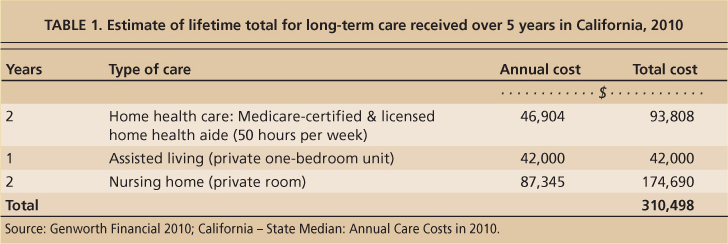

Long-term care can be very expensive. A private room in a California nursing home (the most expensive type) averages $239.30 per day or $87,345 per year, and the care recipient must pay for doctor bills, hospitalizations and prescription drugs (Kaiser Commission 2006; Genworth Financial 2010).

While not all Californians will need expensive long-term care, 70% of those over age 65 will need some during their lifetimes. Without advance planning, paying for long-term care could result in sacrificing a lifetime of savings or even losing one's financial independence (California Healthcare Foundation 2010).

Age, gender, marital status and lifestyle choices influence whether or not a person will need long-term care. The older a person gets, the more likely that it will be needed. Regardless of health status, the very old (over age 85) may need assistance with activities of daily living, such as household chores or transportation (Family Caregiver Alliance 2005). Women are more likely than men to need long-term care, and typically for a longer period of time (average 3.7 years) than men (average 2.2 years) (US DHHS 2002).

Women 65 or older today have a 44% chance of entering a nursing home at some point, compared with 27% of men (Genworth Financial 2006). A single or widowed elder is more likely to need long-term care than one who has a spouse or partner at home. Lifestyle choices such as smoking, sedentary living and poor nutrition increase the risk of needing long-term care and may result in the need for more extensive services at the end of life.

Several factors affect what an individual actually pays for care. Often, the intensity and duration of care increase over time and may coincide with a progression of care settings from home and community, to assisted living, and in some cases to a nursing home. For example, an elder might need occasional assistance (once or twice per year for certain activities such as traveling), then periodic assistance (monthly or weekly, for activities such as cleaning and shopping), then daily assistance (with tasks such as preparing meals, bathing and dressing), and finally assistance and supervision 24 hours per day. Increasing levels of care are usually more expensive. Homemaker services (shopping, meal preparation, cleaning, etc.) are generally less expensive than home health care, which usually costs less than assisted living. Skilled nursing care is the most expensive.

A person's age when care begins influences how long care will be needed, and thus the lifetime costs. Someone who receives long-term care at age 65 will probably require care for more years than one who begins at age 85. Those who are cognitively impaired, as with Alzheimer's disease, may need care for longer because the disease affects the ability to live independently but doesn't necessarily shorten life. Costs also depend on where a care recipient lives. California has some of the highest costs in the country, and averages about 15% higher in urban than in rural areas (Genworth Financial 2007).

The Web site www.medicare.gov has a calculator for estimating one's potential lifetime care costs. The Long-term Care Planning Tool uses a confidential survey and national usage data to create a customized estimate, suggest types of long-term care services that might be needed and identify possible financing options, including insurance.

Another approach is to project the types of care a person may need over a lifetime and how many years for each, then calculate estimated lifetime costs using local cost data. The default planning scenario used by the Federal Long-Term Care Insurance Program (for federal employees) is 5 years: 2 for home health, 1 of assisted living and 2 of nursing home care (table 1). Since most Californians will likely need some type of long-term care as they age, although the type and duration of care will vary, it is important for families to address the issue of long-term care as part of a comprehensive personal financial plan.